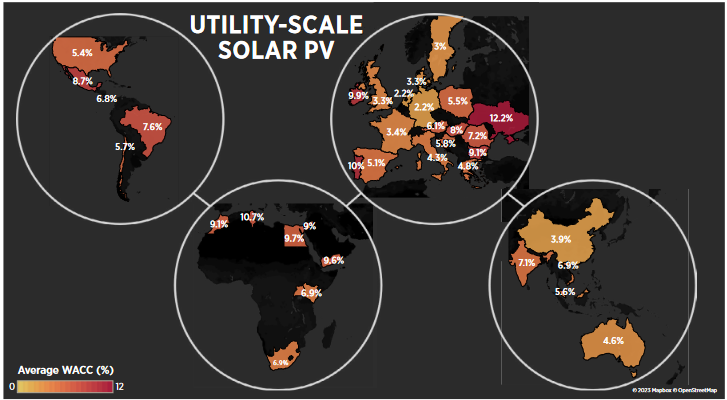

The International Renewable Energy Agency (IRENA) has released new data on the cost of capital for solar PV, onshore and offshore wind in the period between 2020 and 2021. Results show that Germany and the Netherlands have the lowest cost of capital in Europe at 2.2%, while the United States, China, India, and Australia show values of 5.4%, 3.9%, 7.1%, and 4.6%, respectively.

IRENA has published a first-of-its-kind report on the cost of financing for renewable power, covering solar PV, onshore, and offshore wind technologies across all major global markets.

The agency obtained the data from 172 survey answers from 56 experts as well as 33 interviews. The responses provide the cost of capital (CoC) data from 45 countries for at least one of the three renewable technologies across six continents.

The cost of capital expresses the expected financial return, or the minimum required rate, for investing in a company or a project. It is calculated as the weighted average between the costs of debt and equity, where the cost of debt is the interest rate that a project secures from lenders, and the cost of equity is the financial return expected by shareholders in exchange for providing capital.

The cost of capital is a major determinant of the levelized cost of electricity (LCOE) for solar PV and other renewables. According to IRENA, the total cost of electricity for a representative PV project increases by 80% if the CoC is 10% rather than 2%.

“Even small differences in CoC that are not properly accounted for between countries and technologies can result in significant misrepresentations of renewable energy costs and lead to poor policy making,” IRENA says in the report. “Reliable data and an enhanced understanding of the composition of the CoC and its drivers are therefore critical to developing tailored support mechanisms and market designs that take different technology and country risks into account.”

Part of the article excerpted from the network, infringement contact deleted.