Component cost declines, local manufacturing and distributed energy are the three big trends for the renewable energy sector this year, according to S&P Global.

Ongoing supply chain disruptions, shifting renewable energy procurement goals, and a global energy crisis took hold in 2022. This year, some of these trends are evolving to a new stage in the energy transition, says S&P Global.

After two years of feeling the effects of tightened supply chains, raw materials and shipping costs are declining in 2023. Global shipping costs have lowered to pre-pandemic levels. However, S&P Global says this cost relief won’t immediately translate to lower coverall capital expenditures for renewable energy projects.

S&P Global says land access and grid connections are proving to be the biggest bottleneck for the industry. This is leading to an unintended consequence of driving up development costs, as investors rush to deploy capital in markets where interconnection availability is insufficient, and investors are willing to pay premiums for faster, construction-ready projects.

Another change pushing prices upward is the shortage of skilled workers, causing a rise in construction labor costs. This, along with a rising cost of capital, will likely prevent any noticeable price declines in project capex in the near term, says S&P Global.

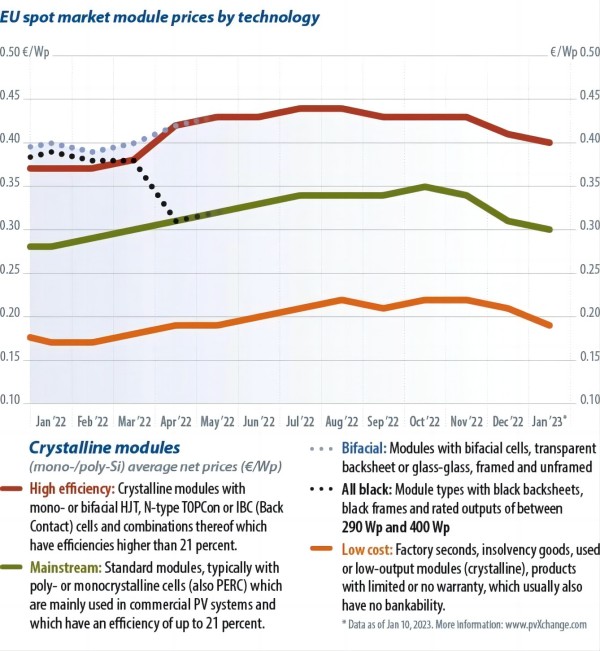

PV module prices have fallen faster than expected in early 2023, as polysilicon supply becomes more abundant. This relief will likely trickle down to module prices, though it is expected to be offset by manufacturers looking to recover margins.

Further down the value chain, installers and distributors are expected to increase their margins. S&P says this will likely lead to less cost relief benefits to rooftop solar end-users, while utility-scale developers will benefit from lowered costs more. S&P projects utility-scale demand to intensify globally, particularly in cost-sensitive emerging markets.

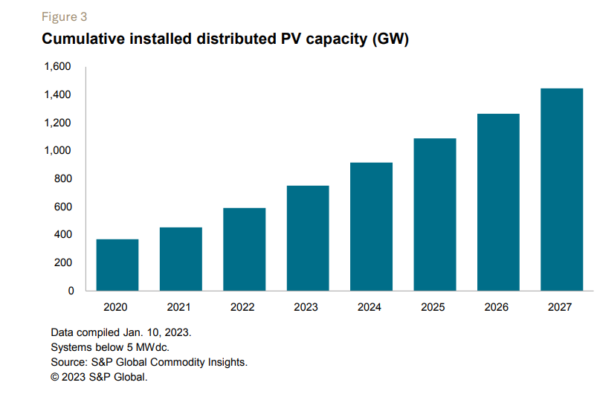

In 2022, distributed solar consolidated its position as a mainstream electricity supply option in many established markets. In 2023, S&P Global expects the technology to spread to new consumer segments and gain ground in new markets. New types of households and small businesses will gain access as shared solar options become available, and PV systems are expected to increasingly be attached with energy storage.

Among households, upfront cash payments remain the most common investment option, though electricity distributors continue to push for a more diversified landscape that includes rental, lease, and power purchase agreement contracts. These financing models are expected to spread beyond the United States, where they have been deployed extensively over the past decade.

As liquidity becomes a major concern for many businesses, commercial and industrial customers are expected to increasingly adopt third-party financing as well. For the providers of third-party financed PV systems, the challenge is to secure contracts with credit-worthy offtakers, says S&P Global.

The overall policy landscape is expected to favor more distributed generation, either through cash grants, value-added tax reductions, tax rebates, or feed-in tariffs.

Supply chain challenges and national security concerns have led to an increased focus on local manufacturing of solar and energy storage, particularly in the United States and Europe. An emphasis on reducing reliance on imported gas has caused renewable energy to become the center of energy supply strategies.

New policy like the Inflation Reduction Act in the United States and REPowerEU in Europe are drawing in large investment in new manufacturing capacity. It will also lead to a boost in deployment. S&P Global expects a 2023 global buildout of close to 500 GW of wind, solar, and battery energy storage, over 20% more than the amount installed in 2022.

“However, concerns persist over Chinese dominance of the manufacturing of the equipment – particularly for solar and batteries – and the various risks involved in being over-dependent on a single region to supply the required goods,” says S&P Global.

Overall, the market outlook is positive. Demand for small systems in particular will continue for quite some time and will offer work for installers. The days of panic buying and consumers blindly accepting quotations, as we saw last year, are probably over.

As far as installers are concerned, more competition will revive business and make it more transparent, and system prices will stabilize. But industry representatives also see growth in medium-to-large PV projects, especially in non-subsidized systems. With forward-looking component purchasing, sound costing, and quality-conscious implementation, investors can look forward to rising returns and commercial businesses to a lasting reduction in energy costs.

Part of the article excerpted from the network, infringement contact deleted.