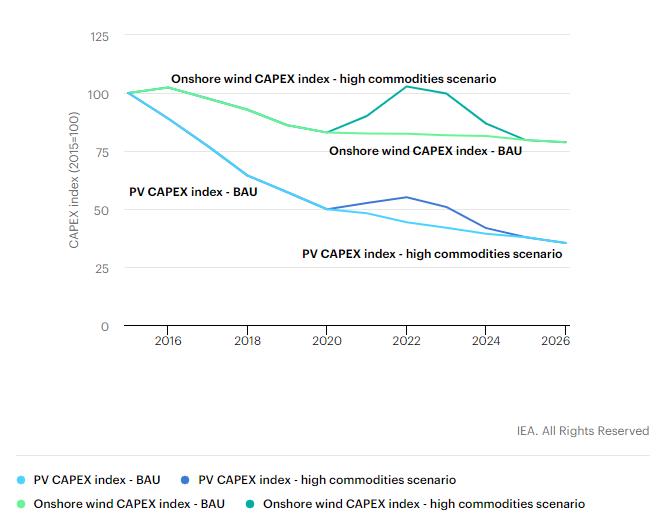

Rising commodity, energy and shipping prices have increased the cost of producing and transporting solar PV modules, wind turbines and biofuels worldwide. Since the beginning of 2020, prices for PV-grade polysilicon more than quadrupled, steel has increased by 50%, aluminium by 80%, copper by 60%, and freight fees have risen six-fold. Compared with commodity prices in 2019, we estimate that investment costs for utility-scale solar PV and onshore wind are 25% higher. In addition, restrictive trade measures have brought additional price increases to solar PV modules and wind turbines in key markets such as the United States, India and the European Union

Impact of high commodity price scenario on utility-scale solar PV and onshore wind investment costs, 2015-2026

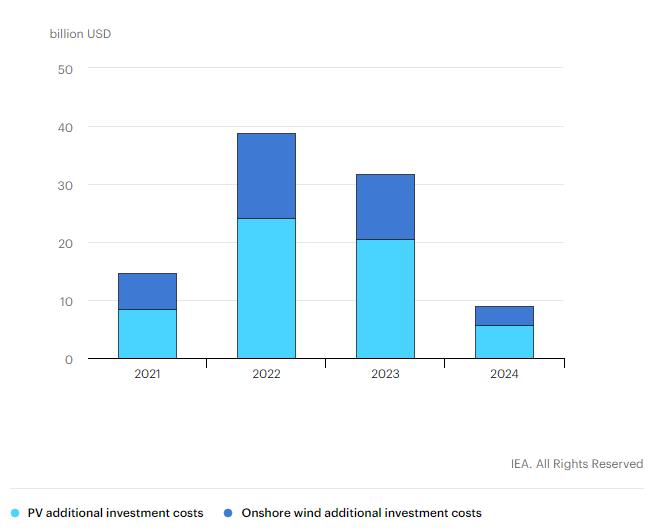

Impact of high commodity price scenario on total utility-scale PV and onshore wind investment, 2021-2024

Around 100 GW of contracted capacity risks being delayed by commodity price shocks. Equipment manufacturers, installers and developers are absorbing cost increases in different ways, with some sectors being more heavily affected than others. Smaller companies are more exposed because of their more limited finances. Higher prices for solar PV and wind plants pose a particular challenge for developers who won competitive auctions anticipating continuous reductions in equipment prices. If commodity prices remain high through 2022, three years of costs reductions for solar and five years for wind would be erased. The increased costs would require over USD 100 billion of additional investment to install the same amount of capacity. This is equivalent to increasing today’s annual global investment in renewable power capacity by about one-third.

But higher natural gas and coal prices have improved the competitiveness of wind and solar PV. For corporations, fixed-price renewable energy contracts serve as a hedge against higher spot prices for fossil fuel energy. For governments, higher electricity prices have not brought higher subsidies for wind and solar PV, as around 90% of all wind and PV projects have long-term fixed-price purchase agreements.