With increasing capital commitments, there is now a shift to minority investments and emergent technology subsectors. pv magazine evaluates the M&A outlooks provided by CohnReznick Capital and FTI Consulting.

CohnReznick Capital Markets shared that the 2o23 U.S. renewable energy market is expected to be defined by the the juxtaposition of tremendous momentum from recent changes in U.S. policy and uncertainty stemming from upheavals in global markets.

As the International Energy Agency expects 2,400 GW of renewables to come online through 2027, the world will add as much renewable energy capacity in the next five years as it did over the last two decades. With this market evolution comes the opportunity for significant merger and acquisition (M&A) activity, and the profile of this activity is expected to shift.

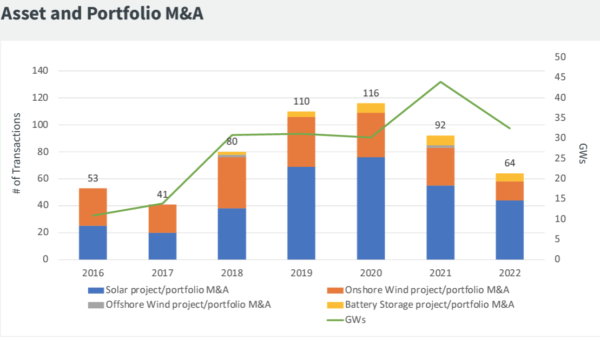

Throughout 2020 and 2021, M&A activity for renewables surged as valuations for platforms, which included project portfolios and corporate development teams that manage them, reached all-time highs. Now with increasing capital deployment rates, there is a shift from majority platform M&A activity to transactions in which investors could take a minority stake.

“Investors are providing growth capital in the form of a minority stake, often receiving preferred equity in a company that has the potential to grow and expand in the post-IRA world, in which company value could increase substantially over the next few years,” said CohnReznick in a whitepaper.

There is a growing trend of international players acquiring experienced U.S. developers with strong project portfolios, and CohnReznick said it expects this trend to continue in 2023. International independent power producers and infrastructure funds see acquisition as an efficient tool to enter or expand their presence in the growing North American market. Corporate M&A activity that includes developer experience and a portfolio of projects offers scale and transaction efficiency that the acquisition of individual projects aren’t able to match.

Now that the Investment Tax Credit (ITC) and Production Tax Credit have been extended for projects that begin construction before 2034, independent power producers and infrastructure funds are looking to access a much larger project pipeline through acquisition, according to CohnReznick.

As the ITC now includes energy storage, this category is expected to drive more M&A activity as well. Mercom Capital reported there were 23 energy storage M&A transactions through the first three quarters of 2022 compared to 15 in 2021, a trend that is expected to continue as the energy storage market matures.

Part of the article excerpted from the network, infringement contact deleted.